Key Features

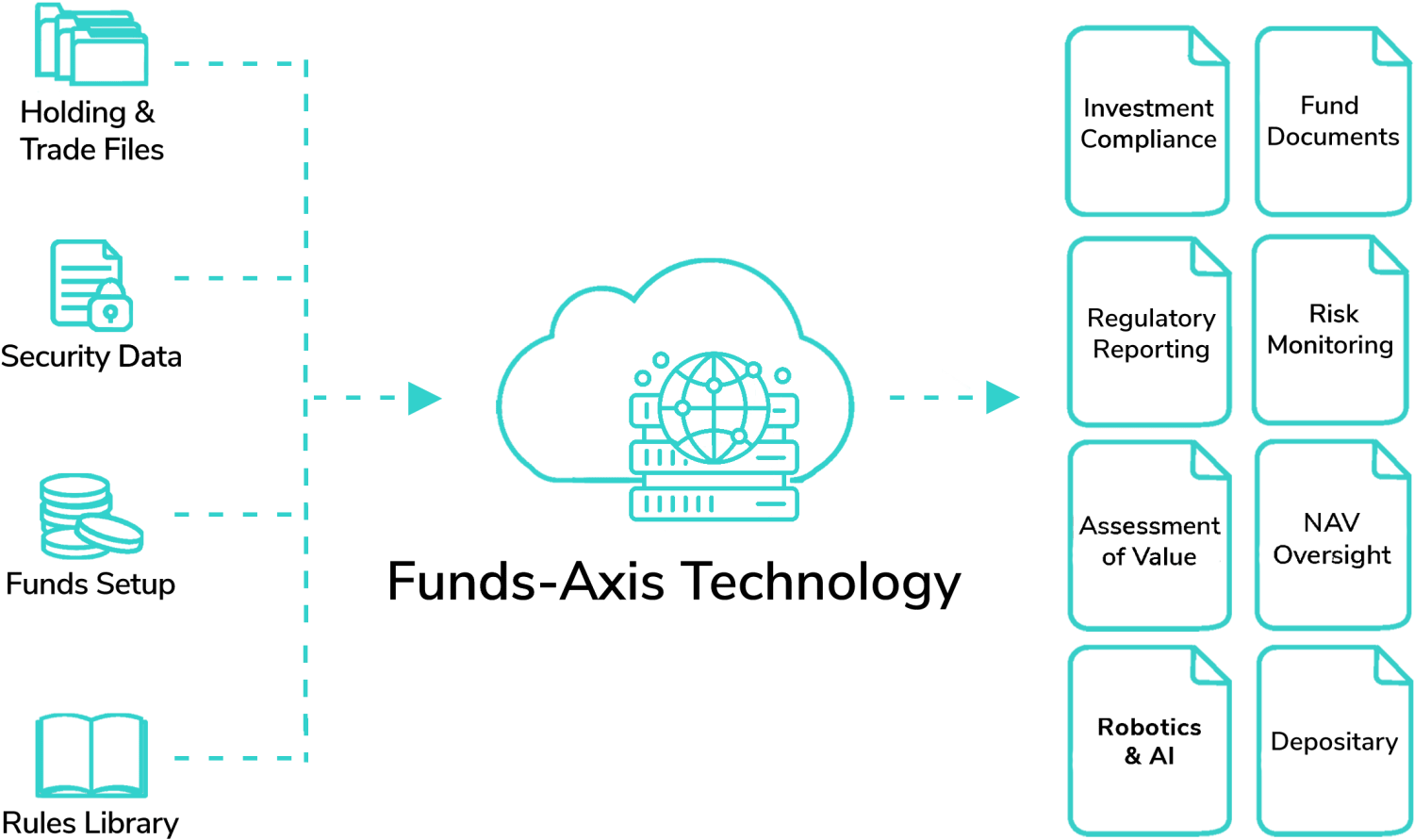

Our monitoring solution is being used by leading global asset managers, banks, management companies, fund administrators and custodians to automate their regulatory compliance through industry-leading cloud technology.

In-built rules engine containing 2,000+ investment rules maintained and fully up to date

Ability to create customised rules to meet your monitoring requirements

Comprehensive liquidity, leverage and counterparty risk monitoring functionality

Available as Technology-only or as a Managed Service

Email alerts and notifications of breaches

Interactive Dashboard Reporting

Full history and audit trail

Data quality built-in

Benefits

How it Works

Our US Tech Modules

US 1940 Act

Interactive Real-Time Reporting

Time Series Reporting

All Calculations

Full Transparency

US Schedule 13D/G

Comprehensive rules engine

Early warning thresholds

Aggregation at multiple levels

Full disclosure workflow

Single click form generation

US Form 13F

Translation of SEC 13F PDF list

CUSIP Auto-match

Performance of all relevant exclusions, calculations and summations

Auto-population of the 13F Form

XML Submission

Form PF

US Form CPO-QPR

Data Aggregation

Rules and Taxonomy

Validation

AIFMD Annex IV

All Data Aggregated

Secure Data Maintenance for all AIFM and AIF Data

Article 3 Exposure, Commitment and Gross Method Exposures

XML Conversion

US Rule 18F-4

Portfolio limits

Financial commitment transactions

Asset segregation requirements

Limits on Fund Leverage Risk

Form N-RN

US SEC Liquidity Monitoring

4 buckets of liquidity

Monitoring of portfolio assets, investor dealing & other liabilities

Monitoring against a highly liquid minimum

Liquidity reporting

Rule 22e-4

US Form N-Port

Portfolio level and position level risk

Pricing of portfolio securities

Repurchase agreements, securities lending activities, and counterparty exposures

Data aggregation

Automated XML report generation

US Form N-CEN

Investment in controlled foreign corporations

Securities lending

Data aggregation

Automated XML report generation

US Form PF

Data Aggregation

Rules and Taxonomy

Validation

Our US Tech Modules

US 1940 Act

With our US 1940 Act Investment Compliance Monitoring Software we offer out-of-the box coverage of the US 1940 Act regulation. This is kept fully up-to-date including for SEC proposals on Asset Segregation and Liquidity Monitoring.

US Rule 18F-4

The US Securities and Exchange Commission’s (SEC) proposed Rule 18f-4 would impose new overall portfolio limits on the leverage that can be achieved through the use of derivatives and so-called “financial commitment transactions”, while also modifying the asset segregation requirements that apply.

Our comprehensive out-of-the box Derivatives and Risk Monitoring solutions meet all regulatory requirements for UCITS, AIFMD & SEC Rule 18f-4.

US SEC Liquidity Monitoring

On October 13, 2016, a unanimous US SEC adopted far-reaching rules intended to address mutual fund liquidity risks.

The Funds-Axis’ liquidity risk measurement framework is a comprehensive solution for considering both asset liquidity risk and liability liquidity risk, both in normal and stressed market conditions.

US N-Port

Form N-PORT is an updated portfolio reporting form adopted by the SEC in October 2016 to modernize portfolio reporting and disclosures by Registered Investment Companies (RICs) and ETFs organized as UITs, but excluding Money Market Funds (MMF) and Small Business Investment Companies (SBICs).

The Funds-Axis solution can assist in gathering information from multiple source systems and normalising, enriching and transforming the data required to be reported.

US N-CEN

Form N-CEN was established by the SEC on 13 October 2016, as part of a wider plan to modernise the reporting and disclosure requirements of certain Registered Investment Companies (RIC’s).

Form N-CEN requires reporting of information relating to:

- The background and classification of the fund;

- The Funds’ Directors and Chief Compliance Officer(s);

- Any investment in controlled foreign corporations; and

- Securities Lending.

Schedule 13D/G

When a person or group of persons acquires beneficial ownership of more than five percent of a voting class of a company’s equity securities registered under the Securities Exchange Act, they are required to file a Schedule 13D with the SEC. Depending upon the facts and circumstances, the person or group of persons may be eligible to file the more abbreviated schedule 13G in lieu of Schedule 13D.

Our automated shareholder disclosure monitoring software provides automated monitoring of global shareholder disclosure rules across 80+ countries on a single platform.

US 13F Reporting

Institutional investment managers who hold at least $100 million in market value of qualifying securities are required to file a 13F Report within 45 days of each calendar quarter. It must be submitted in XML format via the SEC’s EDGAR platform.

Our US Form 13F reporting software takes the complexities of 13F reporting and makes it a fully automated, quick, simple and transparent process. It is available as a stand-alone service or as part of a comprehensive suite of regulatory reporting solutions.

Form PF

Title IV of the Dodd-Frank Act requires registered private fund advisors to file Form PF, at least annually with the Securities and Exchange Commission (SEC).

The form requires information on each reporting fund, including its size, performance, financing, trading and investments of each fund.

Form PF is filed using the IARD system.

CPO-PQR

Each CPO Member that operates pools for which it has reporting obligations under Part 4 of the CFTC’s regulations must, using EasyFile, report to NFA or the CFTC, on a quarterly basis, specific information about the firm and the pools that it operates. These pool quarterly reports (PQR) are due within 60 days of the quarters ending March 31, June 30, and September 30. Reports for the quarter ending December 31 are due within:

- 90 days of the calendar year end for small (AUM <$150 million) or mid-size CPOs (AUM >$150 million <$1.5 billion)

- 60 days for large CPOs (AUM> $1.5 billion)

AIFMD Annex IV

The Alternative Investment Fund Managers Directive 2011/61/EU (“AIFMD”) is an EU law on the financial regulation of hedge funds, private equity, real estate funds, and other “Alternative Investment Fund Managers” (AIFMs) in the European Union and requires to report Annex IV reports to local regulators according to a predefined frequency.

Our AIFMD Annex IV Reporting XML Software enables organisations to rapidly comply with the AIFMD requirements in respect of leverage, liquidity monitoring, risk management and regulatory reporting, without implementation costs or delay.