FCA Consumer Composite Investments (CCI) Solution

Comply with the FCA’s New Consumer Composite Investments (CCI)

Disclosure Requirements with Galaxy

Complete CCI Framework Delivery for Modern Investment Products

The FCA’s new Consumer Composite Investments (CCI) framework replaces UCITS KIIDs and PRIIPs KIDs in the UK, transforming how investment products must communicate information to retail investors. Galaxy by Funds‑Axis delivers a complete, end‑to‑end CCI solution covering traditional and digital product summary document production, associated calculations, machine‑readable outputs, embeddable widgets, and fully hosted portals.

What Do Firms Need to Produce?

Under the final rules, firms must produce three deliverables for every CCI:

1. Digital Product Summary

Interactive, web‑based disclosure for retail investors.

2. Traditional (Document‑Based) Product Summary

A printable, compliant Product Summary Document (PSD).

3. Machine‑Readable CCI Dataset

Structured data file (similar to EMT/EPT) used by distributors to populate their platforms.

Galaxy automates all three from a single data source.

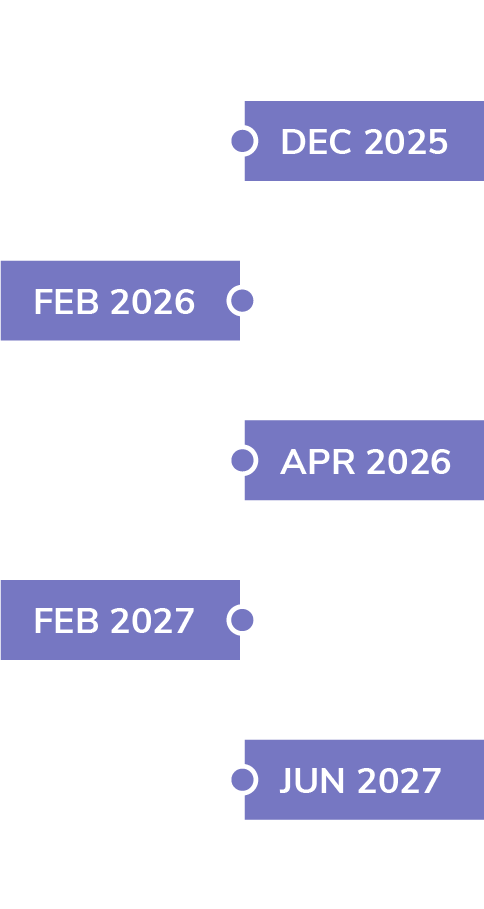

When Do Firms Need to Produce It?

- Legislation Live: Early 2026

- Early Adoption Allowed: From 6 April 2026 (excluding machine‑readable file)

- Mandatory Adoption: 8 June 2027

Recommended Go‑Live

We advise firms to go live by 19 February 2027 to avoid the need for the year‑end 2026 UCITS KIID refresh.

Transition Periods

Specific transition guidance applies to both PRIIPs KIDs and UCITS KIIDs.

The Funds‑Axis CCI Solution

Our solution is built on four integrated components, enabling firms to meet all regulatory, operational, and digital disclosure requirements.

1. CCI Calculations Engine

Automated, regulator‑aligned calculations covering:

Risk & Return Score

- 1–10 scale

- UCITS SD methodology

- Illiquidity adjustments

- Capital‑protection adjustments

Cost Disclosures

- Headline ongoing charges

- Underlying costs for close-ended investments

- One‑off entry/exit costs

- Explicit transaction costs

- Performance fee sample

Past Performance

- Monthly data points

- Linear performance graph

Additional Features

- Full audit trails

- Validation rules & quality checks

2. Traditional Document Production (PSD Generator)

Galaxy enables fast, accurate PSD production through:

- Easy‑to‑configure templates

- Maker/checker workflow

- Upload Excel/XML or integrate with Galaxy Enterprise data management

- Document Library

- Version control & audit trails

- Permalinks for external distribution

- Automated dissemination options

3. Widgets & APIs

A complete suite of embeddable CCI widgets, including:

- Cost breakdowns

- Performance graphs

- Risk metrics

- Narrative blocks

How You Can Use Them

- Embed into your existing portal or website

- Power your own custom front‑ends via API

- Use within Funds‑Axis hosted portals

- Transition to digital factsheets using the same technology

4. Funds‑Axis CCI Portals

Our hosted portals provide a flexible, scalable deployment model:

- Embed via iframe, or

- Insert individual widgets, or

- Use full pre‑built layouts

- Fetch data directly via API

This provides a fast, low‑cost route to digital CCI rollout.

Key Benefits

Fully FCA PS25/20 compliant, reducing operational and regulatory risk

Automated calculations, document generation, and machine-readable datasets

Rapid integration and deployment with minimal disruption

End-to-end audit trails, workflows, and version control

Scalable across multiple products and share classes

Supports both digital and document-based disclosures

Fund Document Solutions

Insights & News

Explore expert content on regulatory change, investor disclosure trends, and digital documentation strategies.

Be Ready for the FCA’s New CCI Regime

Let us show you how Galaxy can automate your full CCI transition – from calculations to PSD production to machine‑readable digital disclosures.

FCA Consumer Composite Investments (CCI) FAQs

What is a Consumer Composite Investment (CCI)?

A Consumer Composite Investment (CCI) is a retail investment product where returns depend on the performance of underlying or reference assets. The FCA’s CCI disclosure regime introduces a new UK framework for how manufacturers provide key product information to UK retail investors.

What does the FCA CCI regime replace in the UK?

The FCA has confirmed that the CCI regime is part of a move away from the previous EU-derived disclosure frameworks, creating a single UK approach for these products. In practice, this is designed to replace legacy PRIIPs/UCITS-style retail disclosure approaches with the new CCI product summary and supporting information architecture.

When does CCI start, and when is it fully in force?

The FCA has set an optional transition period starting when legislation commences on 6 April 2026, where manufacturers can choose to use the new CCI product summary or continue with existing disclosure requirements. The regime applies in full from 8 June 2027.

Who needs to comply with FCA CCI disclosure rules?

The rules apply to firms involved in manufacturing and distributing CCIs to UK retail investors, including asset managers and other product manufacturers, and firms supporting retail distribution journeys.

What is the FCA CCI “product summary”?

The CCI product summary is the core investor-facing disclosure designed to help retail investors understand key information such as risk, costs, and past performance, with flexibility for manufacturers in design while still meeting prescribed content requirements.

Do we need to publish a machine-readable CCI file?

Yes. The FCA’s consultation and subsequent materials describe a requirement for manufacturers to publish a machine-readable file on a public website containing the information they are required to disclose, supporting distributor use and supervisory oversight. This requirement only applies from 8 June 2027.

What is the machine-readable CCI dataset and what is it used for?

The machine-readable CCI dataset is a structured output (for example, a file format that systems can ingest) containing the underlying disclosure information. It helps distributors, platforms, and downstream manufacturers present CCI information consistently and reduces manual rekeying and reconciliation between parties.

What is a CCI Product Summary Document (PSD)?

A Product Summary Document (PSD) is the printable, “durable medium” style version of the CCI disclosure that can be shared as a document when needed (for example, for certain distributor processes or customer preferences). Many firms will operate both digital-first disclosure delivery and a PDF-style PSD output as part of their operating model.

Do CCI disclosures need to be digital-first?

The CCI regime is designed to enable more flexible and digital-friendly disclosure journeys. Market commentary on the final rules highlights a digital-first direction, supported by a machine-readable data layer and the ability to present information digitally while still meeting delivery requirements.

How often do CCI product summaries and data need to be updated?

Firms should plan for at least an annual review/update cycle, and updates whenever information changes materially (for example, to keep risk, costs, and performance information accurate and consistent across channels).

What information is typically included in CCI disclosures?

CCI disclosures are designed to contain comparable, decision-useful information such as:

- Risk/return information

- Costs and charges

- Past performance (where required/available)

- Supporting narrative to help explain the product clearly to retail investors

Is CCI only relevant to UCITS funds?

No. CCIs cover a broader set of consumer investment products where returns depend on underlying/reference assets, meaning CCI readiness often affects multiple product lines and distribution channels – not just one fund type.

What are the biggest operational challenges with CCI compliance?

Common CCI implementation challenges include:

- Creating a consistent “golden source” for risk/cost/performance inputs

- Producing digital product summaries, PSD documents, and machine-readable datasets without inconsistencies

- Managing updates and version control (annual + ad hoc changes)

- Providing evidence, governance, and audit trails across the production workflow

How can Funds-Axis help with FCA CCI implementation?

Funds-Axis supports firms by automating the end-to-end production workflow for CCI deliverables – helping you generate and govern:

- Digital product summary outputs (for web/portal journeys)

- Machine-readable CCI datasets for distributors

- PSD document outputs for durable-medium delivery

…with controlled templates, validations, and audit trails.

Can we launch CCI disclosures quickly without rebuilding our website?

Yes. Many firms choose a hosted or embedded delivery model (for example, widgets or a hosted portal with permalinks) so disclosures can be deployed quickly and updated centrally – without a full rebuild of distributor or investor journeys.

What’s the difference between CCI and PRIIPs KID data templates (like EPT)?

CCI is a UK disclosure regime with a product summary + machine-readable publication requirement, while templates like EPT/EMT are industry data exchange standards used in distribution and disclosure workflows. Some firms will run both (for different audiences/markets), but the compliance obligation and outputs are different.

What should asset managers do now to prepare for CCI?

A strong preparation plan for CCI typically includes:

- Agreeing your optimal go‑live date so internal teams, vendors, and distributors can align around a realistic delivery timeline.

- Reviewing and assessing the technology solution that best suits your needs, including whether to build, buy, or enhance existing capabilities.

- Conducting a product scope assessment to confirm which products fall within the CCI regime.

- Performing a data‑readiness review across risk, costs, performance, identifiers, and classifications to ensure all required inputs are complete and reliable.

- Prototyping early so you can validate disclosure layouts and data outputs well ahead of regulatory deadlines.

What Our Clients Say

See Galaxy’s CCI Solution in Action: A Guided Walkthrough

Experience how Galaxy automates the full CCI disclosure lifecycle – from calculations to PSD production to digital product summaries and machine‑readable datasets. Get a clear view of how our platform streamlines compliance, reduces manual effort, and accelerates your CCI go‑live.

Share a few details and we’ll tailor the walkthrough to your product range, timelines, and operational challenges.