[calendly url=”https://calendly.com/funds-axis/highwire” type=”1″ form_height=”800″ form_width=”800″ hide_cookie_banner=”1″ text_color=”#ffffff” button_color=”#32d1cc” style_class=”custom_form_style”]

Global Funds Technology

Regulatory Reporting

Depositary Solutions

ATLAS Funds Training

Learn anytime, anywhere with our Online Fund Training portal.

Book Your Demo Now

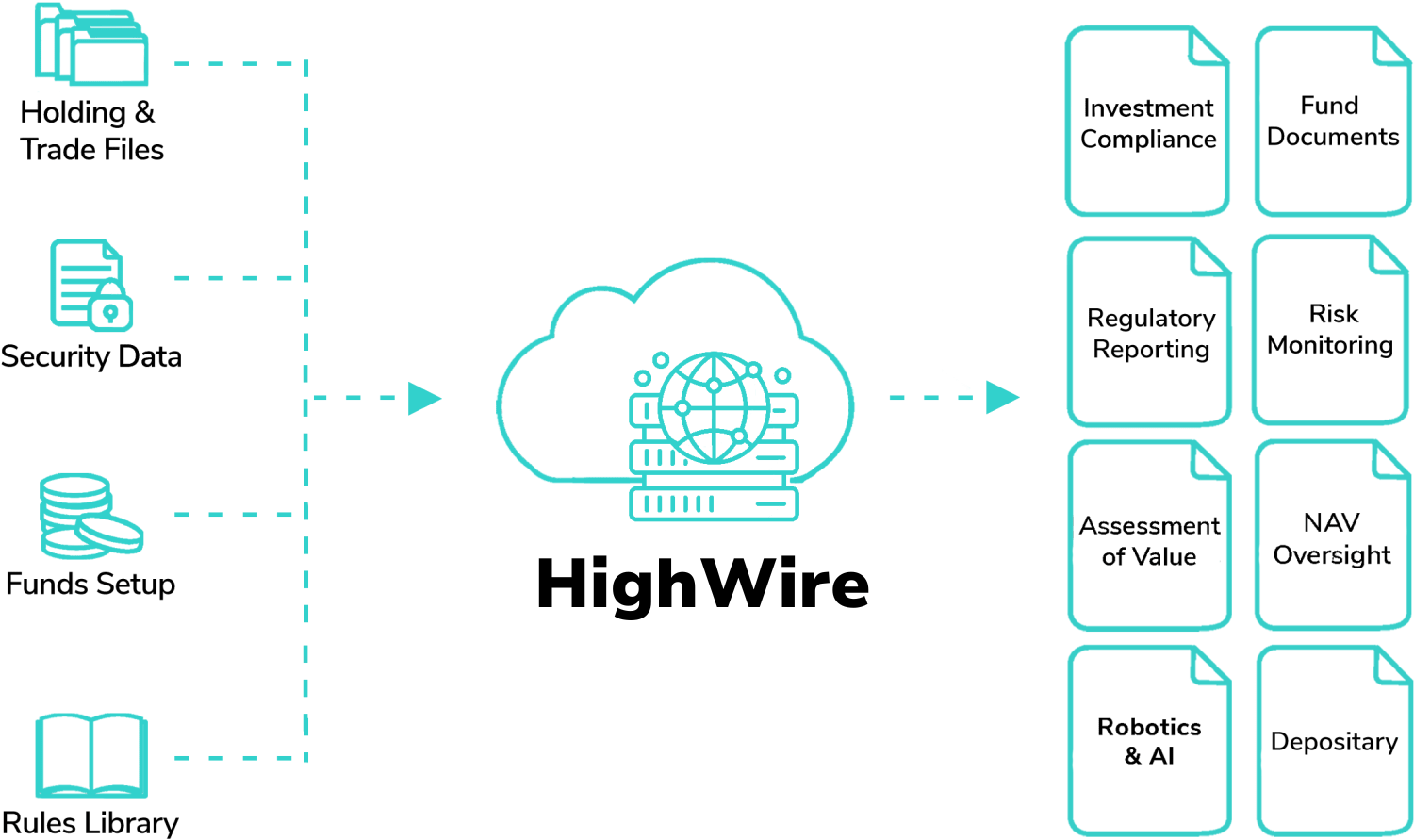

Ready to experience how our multi-modular system can transform your approach to investment compliance, regulatory reporting, risk monitoring, and investor document production? Book your demo now by selecting a date and time that works best for you from the calendar below.

Once you’ve completed the booking, our team will promptly email you to confirm the details of your demo session. Our demos typically last around an hour, during which we’ll showcase the power of our platform firsthand!