The U.S. Securities and Exchange Commission (SEC) recently proposed significant modifications to the mutual fund and exchange-traded fund disclosure framework. The proposed disclosure framework would feature concise and visually engaging shareholder reports that would highlight information that is particularly important for retail investors to assess and monitor their fund investments.

The proposal would:

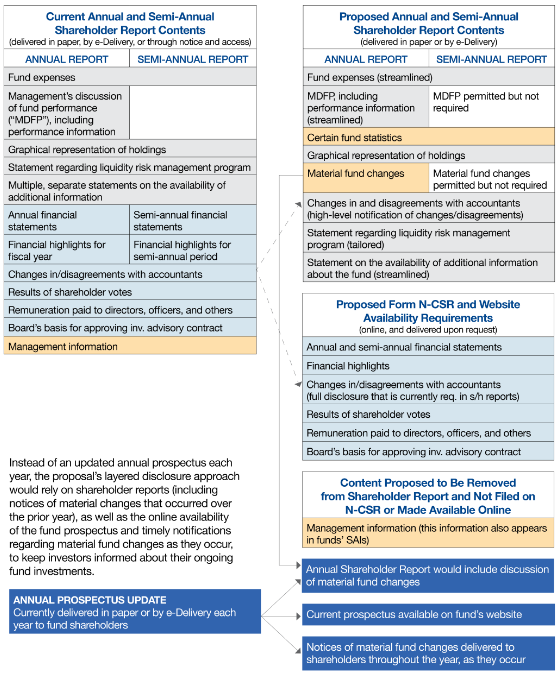

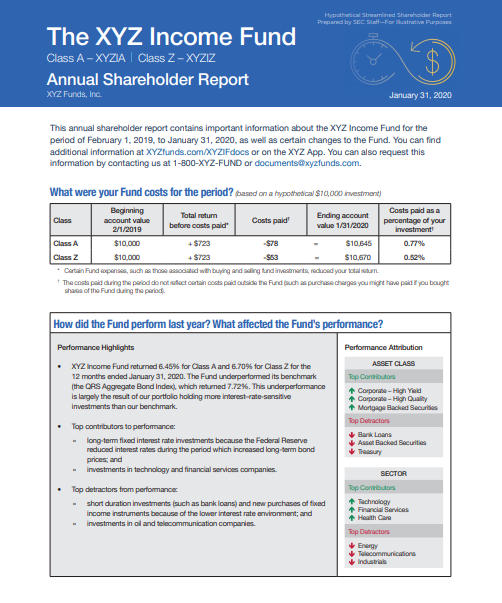

- Require streamlined reports to shareholders that would include, among other things, fund expenses, performance, illustrations of holdings, and material fund changes;

- Significantly revise the content of these items to better align disclosures with developments in the markets and investor expectations;

- Encourage funds to use graphic or text features—such as tables, bullet lists, and question-and-answer formats—to promote effective communication; and

- Promote a layered and comprehensive disclosure framework by continuing to make available online certain information that is currently required in shareholder reports but may be less relevant to retail shareholders generally.

The proposal contains a chart comparing the current required content of annual and semi-annual reports to the proposed new disclosure framework.

Shareholder Reports Tailored to the Needs of Retail Shareholders

Under the proposal, investors in open-ended funds would receive concise shareholder reports designed to highlight information that the Commission believes is particularly important for retail investors to assess and monitor their ongoing fund investments.

This information would include, among other things:

- Fund expenses,

- Performance,

- Illustrations of holdings, and

- Material fund changes.

Tailoring Required Disclosures to Needs of New and Ongoing Fund Investors

The SEC has proposed new rule 498B which provides a different approach to keep investors informed about their fund investment and any fund updates that occur year over year.

Under the proposed rule, new investors would receive a fund prospectus in connection with their initial investment in an open-end fund, as they currently do, but funds would not deliver annual prospectus updates to shareholders thereafter. Instead, under the proposed layered disclosure framework, funds would keep shareholders informed through the shareholder report (including a summary in the annual report of material changes over the prior year), as well as timely notifications of material fund changes as they occur.

Current versions of the fund’s prospectus would remain available online and would be delivered upon request in paper or electronically, consistent with the shareholder’s delivery preference.

Amendments to Scope of Rule 30e-3 to Exclude Open-End Funds

Under the existing framework, beginning as early as January 1, 2021, funds may rely on rule 30e-3, which generally permits a fund to satisfy its shareholder report transmission requirements by providing materials available online and providing a notice of the reports’ online availability.

The proposal would amend the scope of rule 30e-3 to exclude open-end funds. Instead, open-end funds would send the tailored annual and semi-annual reports.

Improvements to Prospectus Disclosure of Fund Fees and Risks

To help ensure investors more readily understand fund fees and risks, the proposal would amend open-end fund prospectus disclosure, and:

- Replace the existing fee table in the summary section of the statutory prospectus with a simplified fee summary,

- Move the existing fee table to the statutory prospectus, for use by investors seeking additional details about fund fees, and

- Replace certain terms in the current fee table with terms that may be clearer to investors.

As the world continues to move towards increased automation and modernization, the SEC’s proposed amendments are a welcome addition to improve transparency and the decision-making ability of retail investors. If adopted as proposed, funds will be required to deliver the streamlined shareholder reports to shareholders semi-annually.

Our Fund Documents Solution will allow funds to automate this process. The Solution currently creates automate Factsheets, KIIDS and PRIIPs KIDs in seconds.

Key features include:

- Beautiful Design

- Custom Layout and Branding

- Comprehensive Statistics

- Interactive Charts

- Web Widgets

- Full API

To find out more about our KIIDs and Factsheets Solution then please contact us for more information.

Arrange A Demo

Error: Contact form not found.